Cash in Transit, or CIT for short, refers to the physical transfer process of cash from one location to another. This usually means moving cash between locations such as banks, ATMs, retail stores, cash centres etc. what they all have in common is they are places where cash is held or used.

A whole industry has grown up to provide a service that will deliver a secure means of transporting cash and other high worth valuables between these locations. A complete infrastructure has also grown up to support the CIT industry such as the manufacture of armoured vehicles, provision of secure cases to carry the banknotes while in transit and the provision of additional security measures to safely transport cash or valuables.

One such company is Oberthur Cash Protection, who use Intelligent Banknote Neutralization Technology to protect the cash from criminal attack while in transit from the cash centre to the end point, be it the bank branch or an ATM in a retail mall.

Historical background to Cash in Transit and the security measures

Ever since early civilisations we as humans have accumulated items of value and looked to protect them from theft. This has always not been easy, especially when looking to move them from one location to another.

As time went on technology was used around the world to make the cash more secure, the earliest known key and lock device was in Assyria before the age of the Egyptian pharaohs. Cash was transported in secure strong boxes or safes on horse and carts, stagecoaches etc. protected by guards and in more recent times with the growth of public transport using trains and aircraft.

The earliest reference to the use of an armoured vehicle to transport valuable goes back to the late 1400’s. Security improved with tumbler locks first appearing in 1778 however, it was the arrival of the combustion engine that saw a leap forward in the design of the cash in transit vehicles, heavier armour coupled with greater firepower given to the guards using automatic weapons, all of which was intended to deter criminal attacks and keep the occupants safe.

The demand for cash in transport services continued to grow with the expansion of bank branches and retail outlets, banknotes increased in usage but it was with the arrival in 1967 of the world’s first ATM in London that saw a dramatic global growth for the need for CIT services to keep them replenished.

Not did just the end points for cash delivery increase, but it was frequently seen in less secure locations in off premise locations such as railway stations, retail malls, petrol station forecourts as ATMs moved away from the Bank branch locations.

With this growth in the movement of cash to feed the ever-increasing numbers of ATMs and retail locations, the CIT industry also faced a growth in criminal activity and the race to keep cash secure got faster as criminals evolved their attack methodologies to overcome the protection measures.

Technology was used, not just the improvement of vaults with composite materials, introduction of new styles of armoured vehicles but also to protect cash when in the cases as they were carried across the pavement from the secure vehicle to the bank branch or ATM.

One of the first technologies to be used to protect case across the pavement was coloured smoke flares that would activate if the case was stolen; another was the use of collapsible poles that would automatically extend making the case difficult to carry.

Not all-new technology has been effective as seen by the use of chemicals to ignite banknotes, which saw collateral damage from the flames. Others such as glue or foam have turned out not to be as practical, flexible or cost effective as IBNS.

However, it was not until the arrival in the early 1980’s of ink to indelibly stain banknotes that saw a paradigm shift in cash protection in all CIT environments.

At the forefront in the development of Intelligent Banknote Neutralization Systems, IBNS, was a French company Oberthur Cash Protection, formally known as Axytrans , with what is generally accepted as the first effective innovative solution. In 1983 the first IBNS patent was granted to Axytrans, in 1985 the first ‘end to end’ solution offered IBNS protection from cash centre to ATM protection system using ink as the neutralization was deployed.

New systems using IBNS protection continued to be seen, one landmark event saw Axytrans in conjunction with Valtis, a French Cash-in-Transit company, who were searching for an alternative way to protect valuables during transit, the result was ATV (Axytrans Transport de Valeurs) which was first used in 1990 by the Belgium Post for their Cash-in-transit operation. Since then Oberthur’s CIT solutions have grown with IBNS protected cases that allow banknotes held in plastic bags or in blocks to be carried across pavements in confidence.

The history of CIT and security protection would not be complete without mentioning the impact of regulation bodies and laws.

One of the first countries to introduce IBNS regulations was France; in 1991, French law was amended to permit the use of ATV on an experimental basis. Valtis began using it to service three regional banks. In Belgium, laws specified the IBNS protection required and even down to the level of arms that the CIT guards should carry. Where as in other countries there has been no government involvement such as the US and UK.

Since then Oberthur Cash Protection has increased its Cash-in-Transit solutions with case carriers such as the CC6000/12000 and with drop safes for use inside the CIT vehicle.

Future direction of the CIT security

Cash protection technology used by CITs such as IBNS, GPRS, tracking etc. will continue to evolve to meet the ever increasing and innovative attack methods adopted by criminals. To see examples of recent attacks see link

In some countries, the attack methods can be extreme such as in the Republic of South Africa where CIT vehicles are frequently attacked with handheld anti-tank rockets. Cash protection is required not just for the case that carries the banknotes across the pavement but for example with drop safes that give added protection in vehicles and the ability to collect unbagged cash from retail terminals etc.

Cultures are changing, those countries where attacks were extremely rare are seeing an increase in frequency, and criminals using the web are able to share successful techniques far quicker than ever before.

Never the less IBNS continues to be an effective deterrent as criminals realise the clear certainty that CIT attacks will be met by the banknotes being indelibly stained, resulting in a greatly reduced value and so not worth the risk.

The CIT industry is facing significant challenges not just from criminals but also with customer behaviours as they move away from the use of cash.

There is acceptance by CiTs that measures should be taken to reduce the carbon footprint of the industry.

In most countries, Covid has impacted on the CIT’s core business. This is encouraging the introduction of one-man vehicles protected by IBNS to provide lower costs, reduce impact on the environment and the smaller vehicles can easily reach the locations where new self-service is being introduced there by reducing risk.

In some countries we are seeing CiT organisations offering a lower cost service based on motor cycle couriers carrying the cash in back packs protected by IBNS.

IBNS solutions for the Cash in Transit industry

CiT organisations look for a cash protection system that will degrade the banknotes in the case regardless of its orientation or location, as well as quickly enough that criminals cannot gain access to the banknotes no matter what attack method they use.

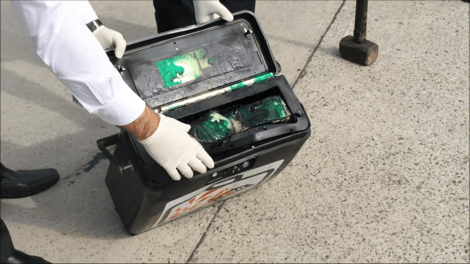

The picture below illustrates what happens when a case equipped with IBNS activates. (Click on the image to watch the video)

The criminals are using an ever increasing variety of attack methodologies coupled with the ever increasing power of handheld tools makes the need to protect cases even more important :

- Cutting attacks with drills, grinders, saws

- Immersing in liquid

- Forced opening with heavy hammers, wedges

- Shooting with high powered side arms in an attempt to overcome the locks

- Dropping from a height in the anticipation that the case will open

All different phases of a CIT activity once the container is armed are or can be under time control: loading in the vehicle, driving, cross pavement to the point of delivery, cross pavement from the point of delivery, etc. Upon expiration of time granted for the operation, the container can alarm and/or activate.

Once the sensors in the case recognise an attack they notify the system to activate, the banknotes will be indelibly stained from just a few milliseconds. With the appropriate ink, these systems will work effectively on paper and or polymer notes.

Containers protected by IBNS are used across the CiT industry; while they can vary, they generally have these characteristics:

- Capacity – from 1,000 notes upwards, normally for across the pavement the maximum number carried is 6,000 notes due to the weight being unmanageable for the courier or prescribed by insurance or regulatory bodies.

Larger capacities, 20,000 or more, can be transported but these cases are equipped with wheels due to the extra weight. - Banknotes in plastic bags – for the ink to reach the banknotes these cases are equipped with wire ‘rippers’ that will heat and melt the plastic bags so the ink can reach the notes.

- Sensors – the cases can be equipped with a range of sensors to recognise when it is being attacked. For example, a mesh in the body of the case which when broken by a drill or grinder will instruct the ink to activate.

- Secure Locks – most common are a dual authentication system (Customer and CiT operative as seen below) with ‘Dallas’ keys, cards or tokens . Alternatively there is single authentication by the customer or CiT operative. There is the ability to work with one time passwords using a smartphone App and a secure server.

- Time Line – it is possible with the latest systems to determine the time that each step of the CiT process will take e.g.travel, across the pavement so if the case has not be disarmed in a predetermined timeframe it will automatically activate

- Tracking – with GPRS these cases can be tracked throughout their journey.

- Ink – indelible ink stains the notes, 100% of the banknotes stained to a minimum of 20%. Some countries require the ink used in these cases to be a different colour to that used in ATM cash protection systems.

There is the option to include a trace element in the ink, when stolen notes are recovered, they can be identified back to the robbery. - Management System – it is important that systems are managed as effectively as possible and include features such as remote authentication, activation etc.

Regulatory Bodies and Testing

Unlike safes or other measures where there is an internationally recognized, there is no such facility for these cases. However, the vacuum is filled by organizations such as CNPP in France, VDS in Germany, ANPI in Belgium or SARB in South Africa who have regulations and certifications that are recognised around the world.

When organisations undertake their own tests, they should consider what they want in the way of protection and how the system will operate for example:

- Speed to activate

- Ink to cover 100% of notes with a minimum coverage of 20% of the note surface

- Stain notes in plastic bags

- Recognise attacks from grinders, hammers etc..

- Ease of operation

- Drop test from 2m

- Weight, size, battery autonomy, tracking capacity, resistance to shocks, heat, cold

Cash in Transit Operational models

There are various cash protection solutions available to CiTs, it is important to select the most appropriate to the operation. The two common methodologies are:

- End to End :

The case containing the cash is armed in the cash centre, cannot be opened until it is at its destination. Once rearmed the case can only be opened when it returns to the Cash Centre. This model will require a case for each stop that is made.

- Across the Pavement

Unlike End to End the case is opened in the CiT vehicle so that cash can be loaded, once it is made secure and armed the CiT operative leaves the protection of the vehicle and walks to the end location which usually means crossing a pavement hence the term. This requires the facility in the CiT vehicle to be able to arm and disarm the case.

The cash taken from the case can then be placed in a secure depository in the vehicle (3). With the one-man operation, using thin-skinned vehicles the cash is protected by IBNS systems. For example, OCP’s Collector Drop where deposited funds can only be accessed when returned to the cash centre.

CiTs vary the way in which they operate for example; they can have routes that involve ATM or retailer locations or a mix. Cases may therefore be required to carry cash only or just ATM cassettes or the ability to do both during a CiT route.

How Oberthur Cash Protection Solutions can protect Cash-In-Transit operations

Oberthur Cash Protection’s IBNS solutions are able to protect ATMs and cash carry cases from the physical attacks that are being experienced today and in the future in all operational environments:

- Delivery and collection of cash

- Single or multiple collections.

- End to End

- Across the Pavement

- ATM replenishment

- Storage – vehicles or cash centres

- Retail

ATV

These IBNS protected case are an ideal solution to provide IBNS protection in vehicles as the individual cases with rapid ink staining of less than 1.5ms can be accommodated in racks. The system includes a collector drop where cash can be deposited to be held securely until the vehicle reaches the security of the cash centre.

CC Series

These easy to use cash carriers have the ability to store up to 6,000 or 12,000 bank notes. These cases are the ideal solution to meet the requirements of CiTs to safely and securely carry cash.

CC Collect

There is an increasing demand by retailers for CiT operatives to collect unbagged cash. These cases can accept deposits of up to 350 banknotes.

CC Light

Ideally suited for those CiT operations where IBNS protection is required in a range of case capacity from backpacks to cases holding 20,000 bank notes.

ATM Cassette Protection – ICSD

These systems will protect the cash in the cassettes when in the ATM and across the pavement or even until the cash cassette reaches the cash centre.

Retail Solutions

OCP offers protection solutions for the secure storage of cash in back offices, when being collected from the tills on the shop floor or Smart Safes.

For further information on the OCP cash protections solutions and how they can help you please contact e.hauw@oberthurcp.com

IBNS are the unique solution to improve both operational efficiency and security of your staff and transported valuables.

Eric Hauw , Global Sales & Marketing Director, Oberthur Cash Protection