With all the recent conjecture about the limited future of cash, digital cash usage will undoubtedly continue to increase, but with half the world’s population without another viable option, including 2 million people in the UK, cash will be here for some time yet.

Cash remains attractive. It is the only safe and inclusive payment option that gives people complete control over their own money, all of which makes it a most attractive target for criminals.

ATM physical attacks continue

Attacks were increasing year on year before the COVID‑19 restrictions, and it was expected that this trend would continue. European Association for Secure Transactions’ 2020 figures (*) showed a continuing trend from the previous year, but with the lockdowns, fraud‑related attacks fell. However, physical ATM attacks continued globally; although the UK saw a decrease of 40%, this was offset by  a 20% rise in Germany and a noticeable increase in the USA, in line with a global trend towards a greater use of explosives.

a 20% rise in Germany and a noticeable increase in the USA, in line with a global trend towards a greater use of explosives.

The global ATM security survey undertaken by Oberthur Cash Protection in conjunction with ATM Marketplace showed that just 32% of contributors expected ATM attacks to decrease post‑COVID. The most predominant attack type reported was hook and chain / rip outs followed closely by explosives.

The survey showed that CEN safes, especially explosive‑resistant models, are being widely installed. A wide range of cash protection measures are being used, but as experience has shown, increasing the strength of armour results in attackers simply resorting to more powerful grinders or, more dangerously, greater amounts of explosives. So the question remains, how should ATM deployers protect their ATMs?

IBNS - the most effective cash protection ?

The answer is to deter the attack in the first place. As per Europol’s 2019 report into ATM security, using Intelligent Banknote Neutralization Systems (IBNS) to indelibly dye banknotes dramatically reduces their value and in some countries renders them worthless.

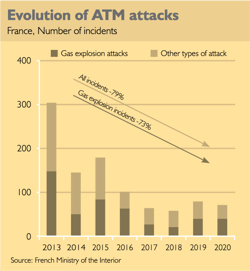

Criminals realise the reward does not justify the risk, and it is far more effective in changing behaviour than traditional approaches for both CITs and ATMs. This was illustrated in France where ATM attacks decreased once IBNS was introduced, and criminal attention then turned towards Germany. IBNS is now a legal requirement for ATMs and CITs in France; in other countries it is left to ATM deployers to select their methodology. The survey showed IBNS is being implemented worldwide.

There are two ATM IBNS approaches: passive, relying solely on the energy generated by the explosive attack to burst the ink container, or active, using an in‑cassette propellant to dispense ink across the notes, a system that provides protection from all physical attack types, making it the more effective option.

The future direction of cash protection

Unlike safes, IBNS has no international standards. Installed systems should be active, meeting the French standard as a minimum to ensure an effective deterrent against all physical attacks, be they explosive or hook and chain.

We can confidently predict that physical ATM attacks will continue to evolve, especially in the areas of explosives and duress. Therefore, deployed cash protection systems should be capable of meeting these challenges and active IBNS will be able to do so.

Increasing the strength of armour results in attackers simply ressorting to greater amounts of explosives.

Paul Nicholls, Business Development Director of Oberthur Cash Protection