18/02/2022 - Reading time 4 min

Cash in Transit Industry: review of the situation in France

Throughout the Pandemic, the Cash in Transit companies played an important role by ensuring the public continued to have access to cash; in the meantime, they became the central pillar of the cash management industry in France

We have seen over the last few years most of the Commercial Banks removing some of their ATMs. Following the path of the Independent ATM deployers (IAD), Cash in Transit companies have initiated to install ATMs, especially in rural areas where there is the most need for readily available cash points.

The cash industry continues to evolve; going green is the next significant challenge that the cash in transit companies, CiTs, will have to face with the intelligent banknote neutralization systems being part of the solution.

Cash in circulation : the pandemic paradox

The increase of cash in circulation in France in 2020

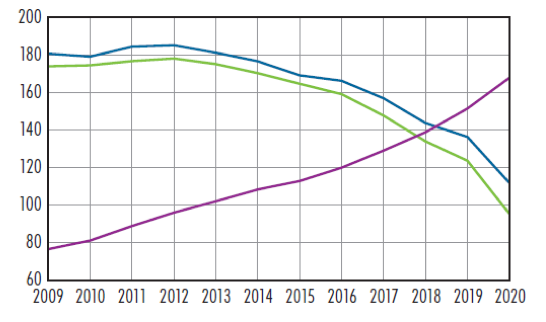

At the beginning of the Pandemic, the public demand for cash has increased significantly, the French Central Bank, “Banque de France”, has recently reported: “Net emission show an increase in 2020 of 11% compared to the same period in 2019”

Net Banknote Flows and Emissions in value at the Banque de France counters (In billions of euros)

Withdrawals Remittance Net Emissions

Sources: BCE, Banque de France // Bulletin de la Banque de France 235/5 – Mai-Juin 2021

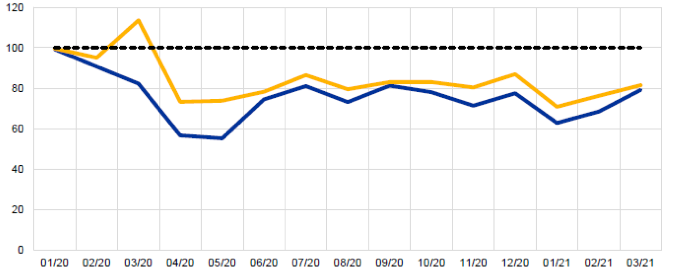

According to a recent paper from the European Central Bank, the sudden increase in the demand for cash in March 2020 could be explained by a stored up demand across the euro area. On the chart below, we can see how the flow of issued banknotes reaches a high in March 2020 compared to the returned banknotes in the same period. Looking to March 2021, we can appreciate how the trend remains at a lower level.

Banknote flows in 2020-21 set against flows in the previous five (non-crisis) years (percentage)

Returned Issued

Sources: ECB

Note: Banknote flow (issued and returned) are compared with the average of those of the previous five (non-crisis) years (2015-2020).

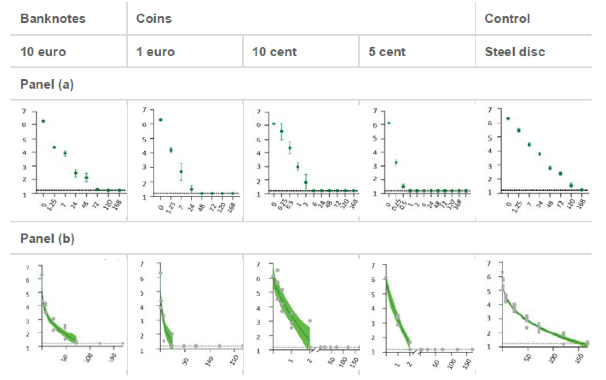

Cash is safe to use and legal tender : European Central Bank report

The volume of cash in circulation has increased despite the unfounded fears that banknotes and coins were transmitting the SARS-COV-2 Virus.

During the height of the Pandemic several attempts were made to discredit the use of cash, but within a few months the European Central Bank commissioned scientific studies. The report confirmed that cash is safe to use and doesn’t contribute to the spread of Covid-19.

Survivability of SARS-CoV-2 on 10€ banknote, 1 euro and 5 cent coins and a stainless steel disc, expressed in simple logarithmic scales, plus the predicted decay times, with starting load of approx. 10*6 TCID50/mL

x-axis: desiccation time (hours), y-axis: logic TCID50/mL

Source, ECB- Occasional Paper Series No 259 – July 2021

The role of the Cash in Transit companies in France during the pandemic.

A social role : ensuring accessibility to cash for people who rely on it

The Cash in Transit operators played an essential role from the beginning of the crisis as there was a key requirement to ensure everyone had access to cash even when there was a dramatic rise in demand.

ATM availability was maintained and another factor in ensuring the public had access to increased amounts of cash was the use of Intelligent Banknote Neutralization Systems, IBNS, that successfully protect ATMs from robberies.

This was especially appreciated by those members of the public who soley rely on cash; it is important to recognize that nearly 0.5m people in France did not have access to a bank account according to a 2017 report from the Banque de France. Also many pensioners withdraw their pension in cash as do those who are on social benefits so that they have a better control on expenses. All these people continued to have access to their money thanks to the efforts made by Cash in Transit companies.

Provide additional services: ATM deployment by Cash in Transit

The cash in transit companies are evolving to include the deployment of their own ATMs in areas where access to cash is not currently possible, this initiative has been applauded by local mayors and authorities. The Media have been promoting these initiatives:

Companies such as Brink’s France or Loomis France are offering to install ATMs, and maintain them, as part of a full service. This initiative allows small towns, villages to have their own cash point meaning that their citizens do not have to travel far to withdraw their money.

Another recent initiative launched by Loomis France operating as an Independent ATM Deployer, IAD, is to provide ATMs at Tobacco shops, a partnership has been signed with the Tobacco dealer union.

The environmental issue: key factor in the future of the CIT industry

The carbon emissions reduction objective: moving away from the traditional transport

The drive to reduce the carbon emissions in city centres will inevitably lead to a change in the way in which cash will be transported in the future.

Traditional heavily armoured vehicles are the most contaminant; this obliges cash in transit companies to find solutions to be able to access the increasing number of low emissions zones. Using electric vehicles is one option although the payload is much reduced by the weight of the batteries and the autonomy remains limited; another option is the hybrid engines or in the longer-term hydrogen powered vehicles.

Alternatively, the cash in transit companies can opt for an alternative to these heavy vehicles by using vehicles below 3,5tons equipped with Intelligent Banknote Neutralization Systems to protect the cash. This means that there is no needed to have fully armoured protection; the vehicles are of lighter weight and therefore are allowed into the city centres ULEZ (Ultra Low Emission Zones) plus can have easier access to those difficult to reach locations where ATMs are increasingly being located.

Incentive for the use of alternative secured solution for cash transport : IBNS

Vans equipped with Intelligent Banknote Neutralization systems for cash protection will be lighter than the traditional armoured trucks. This technology paired with an identification system will allow Cash in Transit companies to operate lighter vehicles and improve their operation costs.

The heavily armoured vehicles have a much higher fuel consumption compared with a soft skin vehicle equipped with an Intelligent Banknote Neutralization System for cash protection. The maintenance cost will be higher due to their heavy weight, the wheel bearings, the brakes; the gearbox etc. will require more frequent attention.

Oberthur Cash Protection offers a range of solutions specifically designed to help cash in transit companies operate more efficiently and safely.

"Since I started working for companies connected to the cash industry back in 2011, I have heard people telling me that cash was dying and was going to disappear in the next 10 years. Well this hasn’t happened and I’ve even seen how public reacted at the early stages of the pandemic, withdrawing cash massively. This makes me believe even more in cash and be thankful to all the members of the cash filiere that make possible for people who rely on cash to have access to it every day.”

Ghislain Kwasny, Business Development Manager, Oberthur Cash Protection